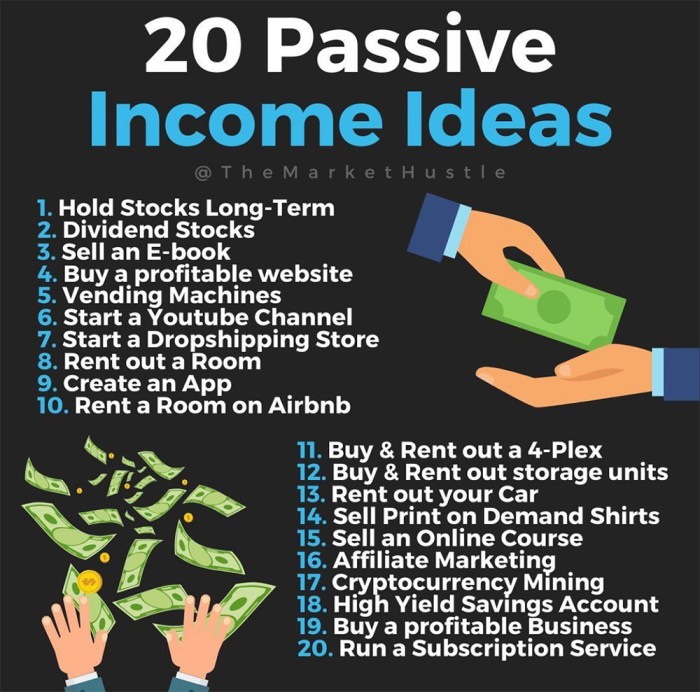

Kicking off with Passive Income Ideas, this opening paragraph is designed to captivate and engage the readers, setting the tone american high school hip style that unfolds with each word.

Are you ready to explore the world of passive income and learn how to make money effortlessly? Let’s dive in and discover the top strategies for generating wealth while you sleep.

Introduction to Passive Income: Passive Income Ideas

Passive income is money earned with little to no ongoing effort required from the individual receiving it. It plays a crucial role in financial planning by providing a steady stream of income that can supplement or even replace active income.

Benefits of Generating Passive Income Streams

- 1. Financial Freedom: Passive income allows individuals to achieve financial independence and have more control over their time.

- 2. Diversification: Having multiple sources of passive income can help spread out financial risk.

- 3. Scalability: Passive income streams have the potential to grow over time without requiring additional time and effort.

- 4. Flexibility: Passive income can be generated from various sources, giving individuals the freedom to choose how they want to earn.

Difference Between Active and Passive Income

Active income is earned through direct participation in a job or business, where time and effort are exchanged for money on a regular basis. On the other hand, passive income is generated from assets or investments that require minimal effort to maintain once set up.

Investments for Passive Income

Investing is a key strategy for generating passive income, allowing your money to work for you. Let’s explore different investment options and how they can help you build wealth over time.

Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it. – Albert Einstein

Real Estate

- Investing in rental properties can provide a steady stream of passive income through rent payments.

- Property value appreciation can also lead to significant returns over time.

- Consider the potential for passive income with vacation rentals or Airbnb properties.

Stocks

- Dividend-paying stocks can provide regular income through quarterly payouts.

- Investing in index funds or ETFs can offer diversified exposure to the stock market with minimal effort.

- Capital gains from stock price appreciation can also contribute to passive income.

Bonds

- Government or corporate bonds offer fixed interest payments at regular intervals.

- Bonds are considered more stable than stocks, providing a reliable source of passive income.

- Consider investing in bond funds for diversified exposure to different types of bonds.

Other Investment Vehicles

- Peer-to-peer lending platforms can generate passive income through interest payments on loans.

- REITs (Real Estate Investment Trusts) allow investors to earn income from real estate without owning physical properties.

- Dividend-paying mutual funds offer a combination of stocks and bonds to generate passive income.

Online Passive Income Ideas

Generating passive income online offers a variety of opportunities for individuals looking to supplement their income streams. By leveraging the power of the internet, you can create passive income sources that require minimal ongoing effort.

Affiliate Marketing:

Affiliate Marketing

Affiliate marketing involves promoting products or services offered by other companies and earning a commission for each sale made through your unique affiliate link. This passive income stream allows you to earn money while you sleep, as long as you have an audience to promote products to. By strategically choosing products or services that align with your niche or audience, you can maximize your passive income potential.

Creating and Selling Digital Products:

Creating and Selling Digital Products

Another popular online passive income idea is creating and selling digital products such as e-books, online courses, stock photography, or software. Once you have created the digital product, you can set up automated systems for selling and delivering the product to customers. This allows you to earn passive income every time someone purchases your digital product without the need for ongoing maintenance or fulfillment.

Utilizing online platforms for affiliate marketing and creating digital products can be lucrative ways to generate passive income and build financial stability over time.

Passive Income through Rental Properties

Investing in rental properties can be a lucrative way to generate passive income. By owning rental properties, you can benefit from regular rental payments without actively working for it. Let’s explore the benefits, tips, and risks associated with rental properties for passive income generation.

Benefits of Investing in Rental Properties

- Steady Income: Rental properties can provide you with a consistent source of income through monthly rental payments.

- Property Appreciation: Over time, the value of your rental properties may increase, allowing you to build equity.

- Tax Advantages: Rental property owners can benefit from tax deductions on mortgage interest, property taxes, maintenance costs, and more.

- Diversification: Owning rental properties can help diversify your investment portfolio and reduce risk.

Tips for Managing Rental Properties Efficiently

- Screen Tenants Thoroughly: Conduct background checks and verify income to find reliable tenants.

- Maintain the Property: Regular maintenance and repairs can help retain tenants and preserve the value of your investment.

- Set Realistic Rent Prices: Research the market to ensure your rental prices are competitive and align with the property’s value.

- Consider Hiring a Property Manager: If managing the property yourself becomes overwhelming, hiring a professional property manager can help streamline the process.

Risks and Rewards of Rental Properties as a Passive Income Source

- Risks:

- Vacancy Rates: Extended vacancies can result in a loss of income and put financial strain on the property owner.

- Property Damage: Dealing with property damage caused by tenants can be costly and time-consuming.

- Regulatory Changes: Changes in rental laws and regulations can impact your profitability and require adjustments to your business practices.

- Rewards:

- Passive Income: Rental properties can provide a steady stream of passive income with minimal effort once established.

- Equity Growth: As the property value appreciates and the mortgage is paid down, your equity in the property grows over time.

- Portfolio Diversification: Investing in rental properties diversifies your investment portfolio and can offer protection against market fluctuations.

Passive Income through Royalties

Royalties are a form of passive income where individuals earn money based on the use of their intellectual property. This can include music, books, patents, trademarks, and more. Essentially, royalties are payments made to the owner of a copyrighted work or property for each use or sale of that work.

Types of Royalties, Passive Income Ideas

- Music Royalties: Musicians earn royalties every time their music is played on the radio, streamed online, or used in commercials or movies.

- Book Royalties: Authors receive royalties for each copy of their book sold, whether in print or digital format.

- Patent Royalties: Inventors earn royalties when other companies use their patented technology or products.

Tips for Maximizing Royalty Earnings:

- Protect Your Intellectual Property: Make sure to copyright your work to ensure you receive royalties for its use.

- License Your Work: By licensing your intellectual property, you can earn royalties from others who want to use it.

- Diversify Your Royalties: Explore different avenues for generating royalties, such as licensing your music for commercials or selling merchandise related to your book.

- Monitor Usage: Keep track of how your intellectual property is being used to ensure you are receiving the appropriate royalties.